Investing vs. Speculating: Which Approach Aligns with Your Risk Tolerance and Financial Goals?

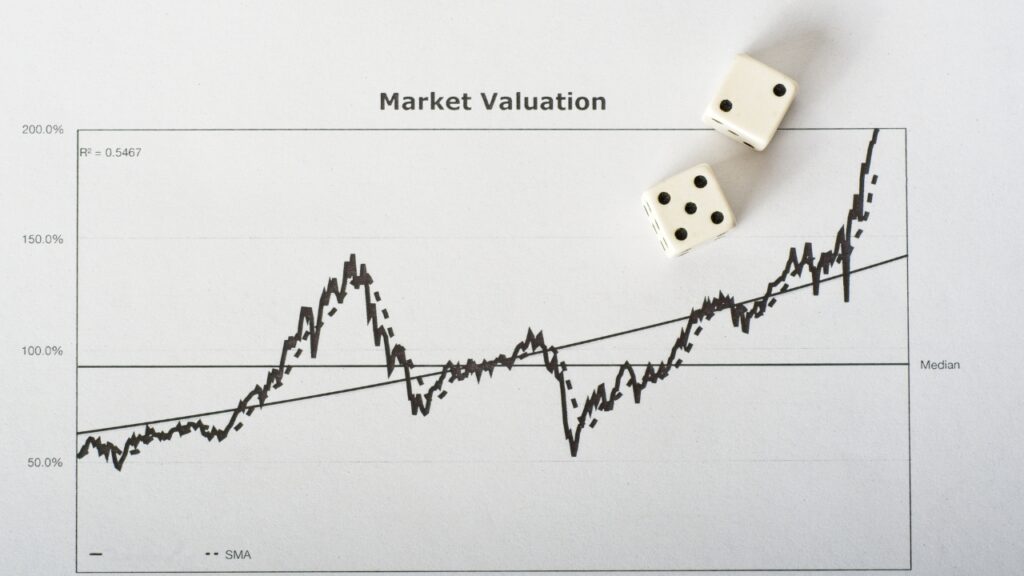

Navigating the financial landscape can be daunting, especially when it comes to distinguishing between investing and speculating. While both strategies offer pathways to potentially grow your wealth, understanding the nuances between them is crucial for aligning with your risk tolerance and achieving your financial goals. Investing typically involves a more structured approach, relying on detailed […]