In the face of a growing housing crisis and economic inequality, Community Development Financial Institutions (CDFIs) are stepping up where traditional lenders fall short. These mission-driven institutions aren’t just financing homes—they’re transforming neighborhoods and giving underrepresented communities access to opportunities they’ve historically been denied.

Whether you’re a low-income borrower looking for an affordable home loan or an investor seeking a meaningful, socially responsible opportunity, CDFIs offer a unique bridge between capital and community. In this guide, we’ll explore how CDFI loans work, who they serve, and how they’re reshaping the real estate and financial landscapes—one neighborhood at a time.

What Is a CDFI (Community Development Financial Institution)?

Definition and Purpose

A Community Development Financial Institution (CDFI) is a specialized financial institution dedicated to delivering responsible, affordable lending to help underserved communities thrive. Unlike conventional banks that prioritize profits, CDFIs are mission-driven—their focus is on financial inclusion and economic development.

CDFIs come in several forms:

- Community development banks

- Credit unions

- Loan funds

- Venture capital funds

All CDFIs are certified by the U.S. Department of the Treasury through the CDFI Fund, which supports them with grants, awards, and low-cost capital to fulfill their mission.

How CDFIs Differ from Traditional Banks

Traditional banks often deny loans to borrowers who don’t meet strict credit, income, or collateral criteria. CDFIs, on the other hand:

- Work with low-income, minority, and rural borrowers

- Accept alternative forms of credit and income verification

- Offer below-market rates and flexible terms

- Focus on community development, not just ROI

While banks prioritize risk reduction, CDFIs prioritize impact—and that changes everything.

What Are CDFI Loans?

Types of Loans Offered by CDFIs

CDFIs offer a wide range of loan products tailored to the needs of their communities. These may include:

- Affordable home mortgages

- Home repair and rehabilitation loans

- Multifamily housing development loans

- Small business loans

- Microloans for startups

- Community facilities and nonprofit financing

They can support individuals, real estate developers, and small business owners with fair terms and minimal barriers to entry.

Who Qualifies for CDFI Loans?

CDFI loans are designed for borrowers who typically don’t qualify for traditional financing. You may qualify if:

- You’re a low- to moderate-income individual or family

- You live in an economically disadvantaged neighborhood

- You’re a first-time homebuyer

- You’re a minority- or women-owned business owner

- You’re building or rehabbing affordable housing

Unlike big banks, CDFIs assess each borrower holistically—looking at financial behavior, stability, and community impact instead of just credit scores.

How CDFIs Support Affordable Housing

Financing for Low-Income Housing Projects

CDFIs play a pivotal role in developing and preserving affordable housing, particularly in gentrifying or neglected areas. They fund:

- New construction of income-restricted units

- Rehab and preservation of existing housing stock

- Mixed-income developments with below-market rents

- Community land trusts and co-op housing initiatives

Because of their flexibility, CDFIs can fund deals that would never get approved by traditional banks, especially in neighborhoods deemed too “risky” by Wall Street standards.

Supporting First-Time and Underserved Homebuyers

CDFIs often serve as a gateway for first-time homebuyers, offering:

- Low down payment options

- Down payment assistance

- Homebuyer education programs

- Financial counseling

For borrowers who are self-employed, immigrants, or have thin credit files, these programs provide a vital lifeline toward homeownership.

Investment Opportunities Through CDFIs

How Investors Can Participate

Investing in CDFIs isn’t just a feel-good activity—it’s a smart, impact-driven financial strategy. CDFIs allow individuals, banks, foundations, and even government agencies to invest in community development while earning a financial return. Investment options include:

- Community Investment Notes

- Loan participation funds

- Private equity in community ventures

- Program-related investments (PRIs) for foundations

When you invest in a CDFI, your capital is pooled and deployed into projects like affordable housing, minority-owned businesses, and underserved neighborhoods.

Risk vs. Reward in CDFI Investments

CDFI investments are generally low to moderate risk but deliver measurable social returns in addition to financial yield. Many CDFIs offer:

- Fixed-rate returns (often 1% to 5%)

- Terms ranging from 1 to 10 years

- Diversified loan portfolios to manage risk

While these investments might not deliver Wall Street-sized returns, they provide peace of mind and a tangible community impact—something many investors value more than short-term profit.

How CDFIs Impact Communities

Revitalizing Underserved Neighborhoods

CDFIs often step in where no one else will. They:

- Finance affordable housing developments in blighted areas

- Support small businesses that drive local job creation

- Invest in schools, clinics, and community centers

- Help stabilize housing markets and reduce displacement

This place-based investing leads to safer streets, better schools, and healthier families. It’s about building lasting wealth at the neighborhood level.

Supporting Minority-Owned Businesses and Housing Developers

CDFIs specialize in working with Black, Latino, Indigenous, and immigrant entrepreneurs who face barriers to traditional funding. They offer:

- Capital for new businesses

- Loans for real estate acquisition or renovation

- Training in financial literacy and business planning

By empowering minority developers, CDFIs also help reshape the real estate landscape with more inclusive ownership and representation.

Benefits of Borrowing from a CDFI

Flexible Lending Terms

CDFIs aren’t bound by the rigid underwriting criteria of big banks. They offer:

- Lower minimum credit score requirements

- Alternative documentation for income

- Customized repayment terms

- Deferred or interest-only payments for start-up projects

This flexibility gives borrowers the breathing room they need to succeed—especially when they’re just getting started.

Focus on Social Impact

CDFIs care deeply about the why behind your loan. Are you building homes for low-income families? Are you starting a daycare in an underserved area? Are you revitalizing a neglected shopping strip?

If your project has social merit, you’re far more likely to get funding. This mission-first approach sets CDFIs apart from commercial banks.

Eligibility Requirements for CDFI Loans

Income and Credit Guidelines

Most CDFIs target borrowers below a certain income threshold (typically 80% of area median income). However, they also consider:

- Steady employment or business income

- Willingness to participate in education or counseling

- A credit score (if available), but alternative credit is often accepted

Don’t be discouraged by a low FICO score. If you’ve paid your rent, utilities, or even cell phone bill consistently, that history can help prove your creditworthiness.

Target Demographics and Regions

CDFIs primarily serve:

- Low-income communities

- Racial and ethnic minority populations

- Rural towns and tribal lands

- Urban areas suffering from disinvestment

To qualify, your project or residence usually needs to be in a designated target market, as defined by the CDFI Fund.

Affordable Housing Programs Offered by CDFIs

Down Payment Assistance and Subsidized Loans

CDFIs often offer down payment grants, matched savings programs, and interest rate buy-downs to help low-income borrowers bridge the affordability gap.

These programs are frequently bundled with:

- Homebuyer education workshops

- Credit counseling

- Post-purchase support to prevent foreclosure

These resources help build long-term housing security, not just a home purchase.

Multifamily and Mixed-Use Development Support

CDFIs fund developers building or preserving:

- Affordable apartment buildings

- Supportive housing for the homeless

- Mixed-use projects that combine retail, housing, and services

They provide predevelopment loans, construction financing, and permanent takeout loans. These tools help developers move projects from concept to completion—especially in markets that are considered “non-bankable.”

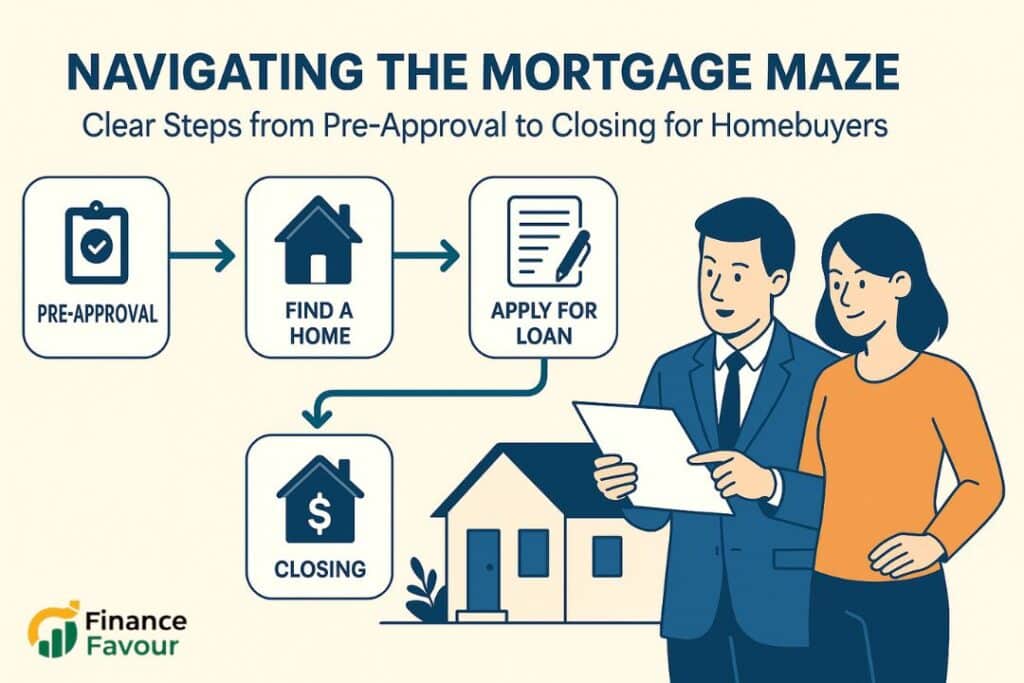

CDFI Loan Application Process

How to Apply for a CDFI Loan

Applying for a CDFI loan is often more personalized and supportive than a traditional loan application. Here’s a basic step-by-step breakdown:

- Find a Local or Regional CDFI: Use the CDFI Fund’s database or local directories to locate one.

- Initial Consultation: Most CDFIs offer a free consultation or intake session to assess your needs.

- Prepare Documents: Gather income verification, business plans (if applicable), tax returns, and ID.

- Submit Application: This can typically be done online or with the help of a loan officer.

- Underwriting Process: The CDFI evaluates your application based on social and financial metrics.

- Loan Approval and Terms Review: You’ll receive a term sheet outlining rates, payments, and any support services.

- Funding and Support: If approved, funds are disbursed, and support services like financial counseling may be offered.

CDFIs often walk you through the process and offer pre-loan education to help ensure your long-term success—not just a short-term transaction.

Documentation and Approval Timeline

Most CDFIs require:

- Proof of income (pay stubs, tax returns, business financials)

- Government-issued ID

- Proof of residence or project location

- Credit report or alternative credit history

Approval timelines can range from 2 to 6 weeks, depending on the complexity of the loan. Housing or commercial development loans may take longer due to underwriting or construction planning reviews.

Top CDFIs Across the United States

National and Regional Leaders

Some of the most respected and impactful CDFIs include:

- Local Initiatives Support Corporation (LISC)

- Self-Help Credit Union

- Opportunity Finance Network (OFN)

- Capital Impact Partners

- Community Investment Corporation (CIC)

These institutions serve borrowers nationwide and often partner with local groups to expand their reach.

How to Find a CDFI in Your Area

Use these resources:

- CDFI Fund’s Certified CDFI Locator Tool (cdfifund.gov)

- OFN Member Directory (ofn.org)

- Local housing agencies and nonprofit organizations

Most CDFIs serve specific geographic or demographic areas, so be sure to look for one that aligns with your location and goals.

Public and Private Support for CDFIs

Government Funding and Grants

CDFIs receive significant support from the U.S. Treasury’s CDFI Fund, which awards grants and technical assistance to help them scale and serve more borrowers. Other federal programs also support CDFIs, including:

- HOME Investment Partnerships Program

- Neighborhood Stabilization Program

- Low-Income Housing Tax Credit (LIHTC) partnerships

These funds allow CDFIs to offer lower rates, better terms, and more loan options for borrowers in need.

Partnerships with Banks and Nonprofits

Many big banks partner with CDFIs to meet Community Reinvestment Act (CRA) obligations. These partnerships include:

- Equity investments in CDFIs

- Loan participations

- Grant funding

- Technical support

CDFIs also collaborate with nonprofits, housing authorities, and faith-based groups to expand affordable housing access and build economic infrastructure.

Comparing CDFI Loans to Conventional Loans

Interest Rates and Terms

CDFI loans tend to offer:

- Slightly higher rates than government-backed loans (like FHA), but lower than private lenders

- Longer loan terms or grace periods

- Tailored terms based on the borrower’s situation

Rates are fair—not inflated—because the goal is affordability, not profit.

Accessibility and Community Focus

The most important difference? Access.

Where traditional banks say “no,” CDFIs say, “Let’s figure this out.” If you’ve been turned down elsewhere, a CDFI might still help you succeed—with financial support and coaching.

CDFIs care about your goals, values, and impact on the community—not just your credit score.

Real Estate Developers and CDFI Financing

Examples of Projects Funded by CDFIs

Across the country, CDFIs have financed:

- Affordable housing in Detroit’s Brush Park neighborhood

- Urban revitalization in South LA

- Transitional housing for formerly incarcerated individuals in Chicago

- Mixed-use buildings with housing and retail in Miami

These projects prove that CDFIs are on the front lines of inclusive real estate development—bridging capital to where it’s most needed.

Case Study: Affordable Housing Complex Success

In Philadelphia, a CDFI partnered with a local nonprofit to build a 40-unit apartment complex for low-income seniors. The CDFI:

- Provided pre-development and construction loans

- Offered below-market interest rates

- Helped the developer navigate tax credits and grants

The result? Dozens of affordable, energy-efficient homes and a revitalized neighborhood block that now includes a health clinic and community center.

Challenges and Limitations of CDFI Lending

Capacity and Funding Constraints

CDFIs are not without limits. They often struggle with:

- Limited funding pools compared to large banks

- High demand from underserved populations

- Balancing financial sustainability with community mission

Because of this, not every application gets approved—and loan amounts might be smaller than conventional financing.

Navigating Local Zoning and Policy Barriers

Even with funding in hand, CDFI-backed projects can get stuck in red tape due to:

- Zoning restrictions

- Permitting delays

- NIMBY opposition

CDFIs often advocate alongside developers and nonprofits to push for policies that support affordable housing and economic justice.

Conclusion

CDFIs are quietly rewriting the rules of finance—one family, one business, and one community at a time. With their focus on affordability, equity, and empowerment, they offer far more than loans: they offer access to a better life. Whether you’re a low-income homebuyer, a minority entrepreneur, or an impact investor, there’s a place for you in the CDFI ecosystem.

Now more than ever, investing in communities isn’t just the right thing to do—it’s a powerful way to shape the future. CDFIs are proving that inclusive growth isn’t a fantasy. It’s happening, and it starts with access to fair, flexible financing.

check this post The Pros and Cons of Investing in Turnkey Rental Properties

FAQs

Yes. Many CDFIs offer investment products open to the public, including notes and loan participation funds. Check with individual institutions for minimums and terms.

While their primary mission is to support underserved groups, many CDFIs serve a wide range of clients—including small businesses, nonprofits, and developers in transitional communities.

No. CDFIs also fund small businesses, community facilities, and nonprofit organizations, depending on their charter and mission.

The timeline varies but typically ranges from 2–6 weeks for consumer loans. Real estate or commercial projects may take longer depending on complexity.

CDFIs reinvest profits into communities, prioritize underserved populations, and combine lending with education and support—making them catalysts for lasting change.