Understanding Mortgage Lenders

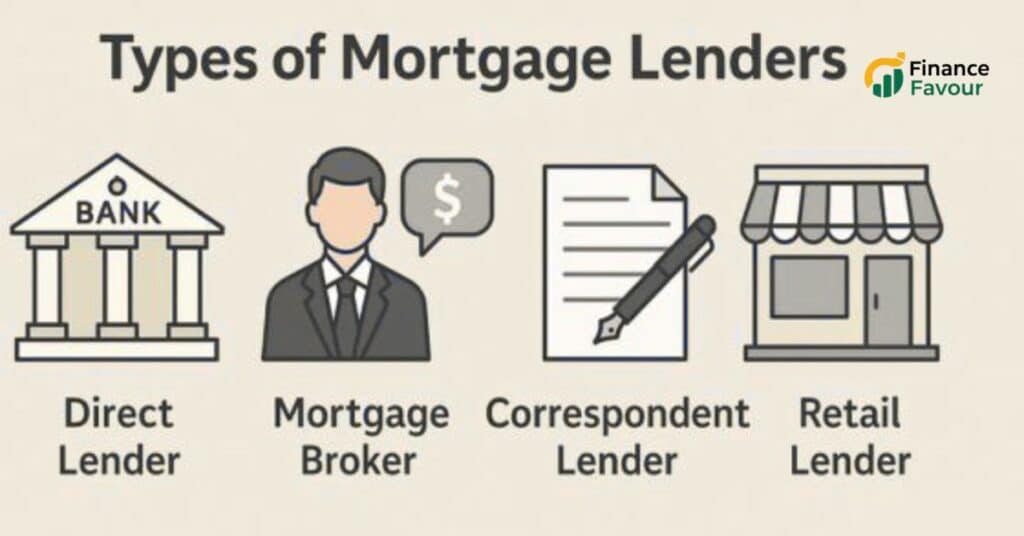

If you’re diving into the world of homeownership, you’re going to run into a lot of financial jargon, and one of the most important terms you’ll encounter is “mortgage lender.” But what exactly is a mortgage lender? In the simplest terms, a mortgage lender is an entity or individual that provides loans to borrowers so they can purchase a home. This might sound straightforward, but the mortgage lending landscape is anything but. There are many different types of lenders out there, and each one comes with its own set of rules, benefits, and potential pitfalls.

Mortgage lenders play a crucial role in the housing market. They determine your loan amount, set the interest rate, and outline your repayment terms. This decision can affect your financial life for decades, so understanding who these lenders are and how they operate is more than just a good idea it’s essential. They range from traditional banks and credit unions to newer online-only platforms and even private individuals in some cases.

In the end, the goal is the same: help you finance your home. But how they go about it and what they offer can vary widely. This is why knowing your options is such a game-changer it helps you make a smarter, more informed decision.

Why Knowing the Types Matters

You wouldn’t buy the first car you see on a lot, right? The same principle applies to choosing a mortgage lender. Understanding the different types helps you find the best deal, save money, and avoid hidden traps. Not every lender is suitable for every borrower. Some specialize in high-credit-score clients, while others cater to first-time buyers or those with low income.

Your financial situation, credit history, and long-term goals should align with the lender’s offerings. For example, if you’re a veteran, a VA lender might provide better terms than a traditional bank. On the flip side, someone with a non-traditional income might fare better with a portfolio lender who doesn’t sell loans on the secondary market.

By understanding each type, you’re not just shopping for a loan you’re customizing your mortgage experience. So, let’s break down these different types of mortgage lenders to find out which one might be right for you.

Traditional Banks

How Banks Operate as Mortgage Lenders

When people think about getting a mortgage, traditional banks are often the first option that comes to mind. These are the big-name institutions Chase, Bank of America, Wells Fargo that offer a wide range of financial products, including home loans. Banks use their own funds to offer mortgages, which means they control the terms, rates, and customer service from start to finish.

Banks typically have a very structured lending process. They assess your creditworthiness, income, debt-to-income ratio, and other financial factors to determine your eligibility. If approved, you’ll get a loan directly from the bank, which will service your loan either in-house or sell it to investors on the secondary market.

One major advantage of using a bank is that everything is usually under one roof. You might already have a checking or savings account with them, which can streamline the approval process. Some banks even offer relationship discounts for existing customers, giving you better interest rates or waived fees.

Pros and Cons of Getting a Mortgage from a Bank

Pros:

- Established reputation: Banks are often well-trusted and regulated, giving borrowers a sense of security.

- Bundled services: You may receive discounts or benefits for consolidating your banking and mortgage needs.

- Wide product range: Most banks offer a variety of loan options, including fixed-rate, adjustable-rate, jumbo, and government-backed loans.

Cons:

- Strict qualification standards: Banks typically have high credit score and income requirements.

- Slower processing times: Due to bureaucratic processes, approvals and closings can take longer.

- Less flexibility: If your financial situation is unique, banks may not offer the flexibility of other lender types.

Traditional banks are a solid choice for borrowers with strong credit and straightforward finances. However, if you need a lender who thinks outside the box, you might want to explore other options.

Credit Unions

What Sets Credit Unions Apart

Credit unions are member-owned financial cooperatives, and that structure makes a big difference when it comes to mortgages. Unlike profit-driven banks, credit unions aim to serve their members who are also their owners. This allows them to often offer lower interest rates, fewer fees, and more personalized service.

You do have to be a member to get a mortgage from a credit union, but membership is usually easy to obtain. It could be based on where you live, your job, or a small donation to a related organization. Once you’re in, you’re entitled to all the benefits they offer.

Many credit unions focus on local lending, which means they understand the unique challenges and opportunities of your area. They also tend to keep the servicing of the loan in-house, so you won’t have to deal with third-party servicers that can complicate things down the road.

Benefits of Borrowing from a Credit Union

Pros:

- Lower interest rates: Because credit unions aren’t focused on profits, they can afford to offer competitive rates.

- Better customer service: Members often receive more personal attention compared to big banks.

- Flexible underwriting: Credit unions may be more willing to work with non-traditional borrowers.

Cons:

- Limited availability: Not all areas are served by large credit unions, and some have stricter membership requirements.

- Fewer loan options: Smaller credit unions may not offer as many mortgage products as big banks or mortgage companies.

- Less tech-savvy: Some credit unions may lag behind in digital platforms or mobile services.

If you value community, service, and potentially lower costs, a credit union could be an excellent choice for your mortgage needs.

Mortgage Brokers

The Role of a Mortgage Broker

Mortgage brokers act as the middlemen between you and potential lenders. Instead of lending you money themselves, brokers connect you with a network of lenders to find the best possible loan based on your financial profile. Think of them like matchmakers but for home loans.

A broker evaluates your credit history, income, debts, and home-buying goals, then shops around to secure competitive rates and terms. They typically work with banks, credit unions, wholesale lenders, and sometimes even private lenders. The advantage is that they can compare multiple loan options without you needing to apply with each lender individually, which can save time and reduce the number of hard credit pulls on your report.

While mortgage brokers can offer you options you may not find on your own, they do charge a fee usually a small percentage of the loan amount, either paid by you or the lender. Still, many homebuyers find this fee worth it for the access, advice, and negotiation they provide.

When to Use a Broker vs. a Direct Lender

Brokers can be a great fit if:

- You have a non-traditional income source.

- You’re a first-time homebuyer and need guidance.

- You’re looking for the most competitive rates.

Direct lenders, on the other hand, are best if:

- You already have a strong relationship with a financial institution.

- Your financial profile is clean and straightforward.

- You prefer a more streamlined process with fewer middlemen.

In short, if you want variety and someone to do the shopping for you, a broker is your ally. But if you prefer dealing directly with the money source, direct lenders might suit you better.

Mortgage Companies

What Are Mortgage Companies?

Mortgage companies specialize solely in home loans. They don’t offer checking accounts or credit cards they’re laser-focused on mortgages. These companies are sometimes called non-bank lenders and they’ve carved out a significant niche in the lending industry. Names like Quicken Loans (now Rocket Mortgage) or Fairway Independent Mortgage Corporation fall into this category.

These companies fund and originate loans but often sell them on the secondary mortgage market, usually to government-sponsored entities like Fannie Mae or Freddie Mac. Once sold, they may continue to service the loan or hand it off to another company.

Mortgage companies tend to be more flexible with underwriting, which makes them an appealing option for borrowers who might not meet the rigid standards of banks or credit unions. They often offer competitive rates, and because mortgages are their bread and butter, their processes are usually efficient and tech-forward.

How They Differ from Banks and Credit Unions

While traditional financial institutions offer a wide variety of services, mortgage companies focus exclusively on home loans, which gives them several advantages:

- Faster approvals: Less red tape and specialization mean quicker processing.

- Broader product options: These companies often have access to multiple loan types and are more willing to work with “outside-the-box” borrowers.

- More personalized service: Especially for first-time buyers, the specialized support can make a big difference.

However, because they often sell your loan shortly after closing, you might end up dealing with a different company for payments and customer service post-purchase. For some borrowers, this is a minor inconvenience. For others, especially those who value consistency, it’s a drawback.

Online Mortgage Lenders

The Rise of Digital Lending Platforms

In today’s digital age, online mortgage lenders have grown rapidly. These platforms let you apply, get approved, and even close on a mortgage completely online. No need for in-person meetings, faxed documents, or drawn-out phone calls. Some of the major players include Rocket Mortgage, Better, and loanDepot.

Online lenders rely heavily on algorithms and automated systems to assess your creditworthiness and generate loan offers. They often promise lower fees and faster turnaround times than traditional lenders. Plus, with 24/7 access to your application status and documents, they offer unmatched convenience.

These platforms appeal particularly to tech-savvy borrowers and millennials who are accustomed to doing everything online from grocery shopping to investing. But convenience doesn’t always mean simplicity, and there are trade-offs to consider.

Pros and Cons of Using Online Mortgage Lenders

Pros:

- Speed: Many online lenders can issue pre-approvals within minutes.

- Lower overhead = lower fees: Digital platforms often pass cost savings to borrowers.

- Transparency: Real-time tracking and document uploads streamline the process.

Cons:

- Lack of personal interaction: If you prefer face-to-face help, online platforms may feel impersonal.

- One-size-fits-all approach: Automated underwriting doesn’t always account for unique financial situations.

- Security concerns: You’ll need to upload sensitive financial information to digital platforms, so cyber security is a must.

Online mortgage lenders are a great fit for borrowers who are confident in navigating digital platforms and want a streamlined, quick process. But for more complex financial scenarios, a traditional lender might still be your best bet.

Correspondent Lenders

Definition and Function

Correspondent lenders originate and fund loans using their own money, just like banks or mortgage companies. However, what sets them apart is that they quickly sell these loans to a larger lender or investor on the secondary market often even before the first payment is due.

They act as a bridge between the borrower and the end investor. They handle the underwriting, processing, and closing, but the long-term loan servicing (who you pay every month) is typically done by someone else.

This model allows correspondent lenders to provide a broad range of loan options because they’re not limited to just their own in-house products they offer loans based on investor guidelines.

How They Fit into the Mortgage Ecosystem

Correspondent lenders offer several benefits:

- Local presence with broader options: Many are community-based but offer access to national loan programs.

- Faster closings: Their familiarity with the local market can expedite the approval process.

- Flexible underwriting: They can shop your loan to various investors for the best fit.

However, the main downside is the possible confusion post-closing. Since the loan is quickly transferred, you might start with one company and end up dealing with another for servicing. Communication is key ask up front who will service your loan to avoid surprises.

Portfolio Lenders

What Makes Them Unique

Portfolio lenders are unique in the mortgage world because they don’t sell your loan after closing. Instead, they keep it in their own portfolio and manage it themselves. This gives them the freedom to set their own rules and guidelines, which can be a major advantage for borrowers with unconventional financial situations.

Because they’re not constrained by the requirements of government-backed agencies like Fannie Mae or Freddie Mac, portfolio lenders can offer more flexible underwriting. They may look beyond a credit score to understand the full picture of your financial health. This can be a game-changer if you’re self-employed, have inconsistent income, or a past credit issue that doesn’t reflect your current financial standing.

These lenders are often smaller banks or credit unions, and they have a vested interest in the local community. That can translate into more personal service, faster decisions, and a willingness to take on “riskier” clients so long as they make sense on paper.

Benefits and Drawbacks

Pros:

- Flexible underwriting: Great for borrowers with unique financial circumstances.

- Stable servicing: You’ll likely deal with the same institution for the life of your loan.

- Personalized approach: Smaller lenders can often provide more individualized support.

Cons:

- Limited availability: Not all areas have portfolio lenders.

- Higher interest rates: Because they’re taking on more risk, rates may be slightly higher.

- Fewer loan products: Their offerings might be more limited compared to large mortgage companies.

If you’ve been turned down by a traditional lender due to non-traditional income or credit history, a portfolio lender might be the solution you’ve been searching for.

Direct Lenders

Who Are Direct Lenders?

Direct lenders originate and fund mortgages using their own capital. Unlike brokers, who connect borrowers with other lenders, direct lenders are the source of the money. Banks, credit unions, and mortgage companies can all be direct lenders if they don’t involve a middleman in the origination process.

The biggest advantage of working with a direct lender is simplicity. You’re dealing with one company from start to finish. That means fewer delays, fewer communication breakdowns, and a clearer understanding of your loan status at any given time.

They typically have in-house underwriters, loan processors, and closers, which allows them to move quickly and efficiently. Direct lenders are often more nimble and responsive compared to large, bureaucratic institutions.

Comparing Direct Lenders to Other Options

Pros:

- Faster processing: No third parties means quicker decisions and closings.

- Clear communication: Everything is handled under one roof.

- Better for experienced buyers: If you know what you want, you can cut out the middleman.

Cons:

- Limited product comparison: You only see what that lender offers, not a broad market view.

- Less personalized guidance: Some direct lenders assume a level of borrower knowledge that not everyone has.

- May not offer niche products: If you need a government-backed loan or special financing, you may need to shop elsewhere.

If you want to keep things simple and know exactly what you need, going with a direct lender can streamline your home-buying process.

Wholesale Lenders

Behind-the-Scenes Mortgage Lending

Wholesale lenders don’t deal with borrowers directly. Instead, they work with mortgage brokers and other financial professionals who act as intermediaries. The wholesale lender provides the funds, while the broker handles the application process and interacts with the borrower.

These lenders often offer competitive rates and fees because they don’t have to maintain a sales staff or customer-facing infrastructure. Brokers help bring them business, and in exchange, the lenders provide attractive loan products that brokers can offer to their clients.

It’s a behind-the-scenes relationship, but it plays a huge role in the mortgage ecosystem. Most borrowers don’t even realize that their mortgage is funded by a wholesale lender because they interact only with the broker.

How They Work with Mortgage Brokers

Pros:

- Competitive rates: Wholesale lenders tend to offer lower rates due to their lower overhead.

- Wide range of products: Brokers working with multiple wholesale lenders can shop around for the best fit.

- Faster funding: The streamlined business model often means quicker approvals and closings.

Cons:

- No direct interaction: You won’t communicate with the lender; your broker handles everything.

- Dependence on broker quality: Your experience is heavily influenced by how competent your broker is.

- Loan servicing may transfer: Like correspondent lenders, wholesale lenders often sell loans after closing.

Wholesale lenders are great when paired with a skilled mortgage broker. Together, they can offer tailored solutions and competitive pricing that might not be available through retail channels.

Hard Money Lenders

A High-Risk, High-Reward Option

Hard money lenders are private investors or companies that offer short-term loans based on the value of the property being purchased not the borrower’s creditworthiness. These loans are often used for fix-and-flip projects, investment properties, or borrowers who need funding quickly but can’t qualify through traditional means.

The approval process is fast sometimes just a few days and the lender focuses primarily on the asset’s value and potential return. This makes them popular among real estate investors who need to move quickly and don’t have time for conventional underwriting.

However, the convenience comes at a price. Interest rates are significantly higher, and the repayment terms are usually short often 6 to 24 months.

Ideal Scenarios for Hard Money Loans

Pros:

- Fast funding: Perfect for time-sensitive deals.

- Flexible requirements: Great for borrowers with poor credit or inconsistent income.

- Asset-focused: The loan is secured by the property, not your financial history.

Cons:

- High costs: Interest rates and fees can be substantially higher than traditional loans.

- Short repayment periods: Not ideal for long-term financing.

- Risk of foreclosure: Missed payments can quickly lead to property seizure.

Hard money lenders aren’t for everyone, but for investors or buyers in unique situations, they can provide a valuable and sometimes life-saving option.

Government-Backed Lenders

FHA, VA, and USDA Loans

Government-backed loans are insured or guaranteed by federal agencies, making them accessible to a wider range of borrowers. These include:

- FHA (Federal Housing Administration): Great for first-time buyers or those with less-than-perfect credit.

- VA (Department of Veterans Affairs): Exclusively for veterans, active military, and their families, offering 0% down.

- USDA (U.S. Department of Agriculture): For buyers in rural or suburban areas, with zero down and income limits.

These programs help make homeownership more achievable by reducing the risk for lenders, allowing them to offer better terms to borrowers who might otherwise be excluded.

Who Should Consider Government-Backed Mortgages?

Pros:

- Low or no down payment: Makes home buying accessible to more people.

- Lenient credit requirements: Perfect for those rebuilding or just starting their credit history.

- Lower interest rates: Because the government backs the loan, lenders are more comfortable offering favorable terms.

Cons:

- Strict eligibility rules: Each program has specific criteria you must meet.

- Additional paperwork: The process can be more bureaucratic.

- Property restrictions: Not all homes qualify under USDA or VA loan guidelines.

If you meet the qualifications, these loans can be a fantastic way to step into homeownership with minimal financial barriers.

Subprime Lenders

Serving High-Risk Borrowers

Subprime lenders cater to borrowers with poor credit, high debt levels, or irregular income those who typically wouldn’t qualify for traditional loans. These lenders fill a critical gap in the mortgage market by offering options when others won’t. However, this service comes at a cost.

Subprime loans often feature higher interest rates, larger down payments, and more aggressive terms. The reasoning? These loans are considered higher risk, so lenders compensate for potential losses through stricter conditions.

These lenders played a major role in the 2008 housing crisis, and while the market has since become more regulated, subprime lending still exists today in a more controlled form. That said, they’re best viewed as a last resort or a temporary solution, ideally replaced with refinancing when financial conditions improve.

Pitfalls and Precautions

Pros:

- Access to homeownership: Even with bad credit, you may still qualify for a loan.

- Custom underwriting: Subprime lenders often evaluate more than just credit scores.

- Potential stepping stone: If used wisely, you can rebuild your credit and refinance later.

Cons:

- High interest rates: Often double or triple the average mortgage rate.

- Predatory practices: Some lenders take advantage of vulnerable borrowers.

- Risk of foreclosure: With stricter terms, even one missed payment can have serious consequences.

Subprime loans can be a life raft for those in dire situations, but they require caution and a strong exit strategy. Always read the fine print and consult with a financial advisor before proceeding.

Choosing the Right Lender

What to Look For

Choosing the right lender is about more than just the lowest interest rate. It’s about finding someone who understands your financial goals, communicates clearly, and offers terms that fit your lifestyle. Here’s what to consider:

- Interest Rates: Compare both fixed and variable options.

- Loan Terms: Look at the length of the mortgage and whether it fits your goals.

- Fees: Origination, application, closing these can add up.

- Customer Service: Responsive lenders make the process smoother.

- Loan Options: Ensure they offer the type of loan that suits your needs (FHA, VA, conventional, jumbo).

Don’t just talk to one lender. Get multiple quotes, ask questions, and read reviews. Remember, you’re entering a decades-long relationship it’s worth taking the time to find the right partner.

Questions to Ask Before Deciding

- What types of mortgage loans do you offer?

- What are your interest rate options and annual percentage rates (APRs)?

- What fees should I expect at closing?

- How long does your loan process usually take?

- Do you service the loan after closing or sell it to another company?

- Are there any prepayment penalties?

- Can I lock in my interest rate, and if so, for how long?

- What’s the best loan you can offer someone with my financial profile?

Conclusion

The world of mortgage lending is vast, and the type of lender you choose can dramatically affect your home-buying journey. From traditional banks and credit unions to modern online platforms and niche players like hard money lenders or subprime lenders, each type serves a specific role in the financial ecosystem.

Understanding the distinctions between these lenders isn’t just good knowledge it’s the foundation for a smart financial decision. Whether you’re buying your first home, investing in property, or refinancing an existing mortgage, matching with the right lender can save you money, time, and stress.

So, take your time, do your homework, and don’t be afraid to ask questions. Homeownership is a major milestone make sure you partner with the right guide to reach it.

You can visit another post Best mortgage lenders of May 2025

FAQs

A mortgage broker acts as an intermediary who finds loans for borrowers from a network of lenders. A lender is a financial institution that provides the loan directly to the borrower. Brokers offer variety, while lenders provide the funds.

Yes, you can switch lenders after pre-approval. Just be aware that a new lender will likely run another credit check, which could slightly impact your score.

Yes, reputable online lenders are safe. Always verify that the lender is licensed and check customer reviews and security protocols to ensure your data is protected.

” Traditional lenders: 620+ (good credit) “

” FHA loans: 580 (with 3.5% down), 500 (with 10% down) “

” Subprime lenders: Under 580 “

” Portfolio/hard money lenders: Flexible but require other strong criteria “

It depends on your needs. Banks offer stability and bundled services. Mortgage companies may provide better rates and quicker service. If you need flexibility or unique loan options, mortgage companies often have the edge.